A Glimpse into 2024: Unpacking Market Dynamics

A Recurring Theme: All Eyes on the Fed

As people self-reflect and set resolutions, the Federal Reserve is also taking time for introspection and planning ahead.

Recent data suggests that the Fed is successfully taming inflation without causing a sharp rise in unemployment. The prospects of a “soft landing” are encouraging Jerome Powell, the Fed’s chairman, to openly discuss the possibility of cutting rates several times this year. The U.S. economy has shown tremendous resilience as unemployment hovers around at a low of 3-4%.

Since mid-2023, analysts were predicting that the Fed would reverse its rate hike policy sooner rather than later, since the cost of credit was negatively impacting businesses and consumers alike. The anticipated “rate peak” around 5.5% largely explains the S&P 500’s strong returns in2023.

Markets are forward-looking and are pricing in the expected policy reversal.

However, it is unlikely that we will return to a Zero Interest-Rate Policy (ZIRP) in the short or medium term. The Fed acknowledges that high rates are unsustainable, but it also recognizes that ZIRP would send inflation skyrocketing.

What does this mean for investors?

The prospect of bond yields maintaining levels reminiscent of the pre-global financial crisis era is a key consideration. The consensus among financial experts suggests that yields may stabilize in the range of 3.5% to 5.5%, in line with historical norms.

We must remember that ZIRP was a historical anomaly - a drastic response to the 2007-08 financial crisis - that created an inflationary environment, both in the real economy and financial markets. The Fed has learned from this mistake and will be mindful to find the right balance between incentivizing economic growth and maintaining monetary discipline.

This is certainly good news for investors seeking fixed-income solutions. That said, 2022 is a testament to the unpredictable nature of investing, with even the safest asset classes suffering historic losses.

Should investors play it safe or venture back into equities?

Corporate Earnings in 2024: A Positive Outlook

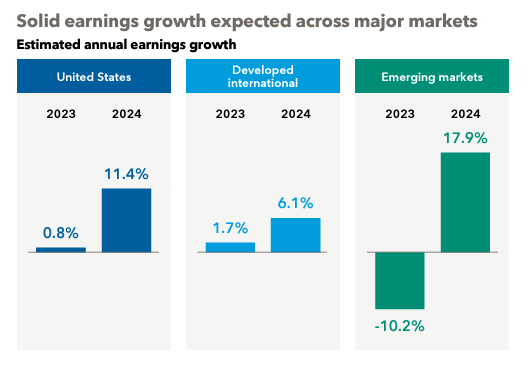

The anticipation of a corporate earnings rebound in 2024is a beacon of hope for investors. Wall Street analysts project an impressive 11% increase in earnings for companies within the S&P 500 Index.

This is nearly double the expected forecast of expected earnings in other developed markets. We believe that investors should continue holding U.S. investments, while maintaining a modest level of exposure to international markets for diversification purposes.

This optimistic earnings forecast, based on consensus data compiled by FactSet, underscores the resilience of the U.S. economy and presents a strong argument in favor of equities.

Our team is prepared to leverage this positive momentum to guide you towards sound investment decisions aligned with your financial goals. We stay true to our conviction that the robust U.S. equity markets present the most favorable risk-reward ratio going forward.

Moving Cash Off the Sidelines: Seizing Opportunities

In the wake of the Federal Reserve's decision to pause further interest rate hikes, an environment conducive to reevaluating cash allocations has emerged. Indeed, this may be an appropriate time to redeploy cash into carefully selected stock and bond investments.

Historically, U.S. stocks have outperformed cash investments after Fed rate hikes have ended. Will history repeat itself? With a one year return of 20%, the S&P 500 has clearly outperformed cash and fixed-income investments. If corporate earnings remain strong and rates start coming down, we can expect a sustained rally in the equity markets in 2024 and 2025.

Staying heavily invested in cash, high interest savings accounts and bonds provides security and relative peace of mind However, their low expected returns may prevent you from reaching your long-term financial goals. Our team is at your disposal to discuss rebalancing your portfolios to ensure optimal asset allocation for 2024 and beyond.

Anders Storvik's Visit to the New York Stock Exchange

We take pride in the achievements of our team members, and it is with great pleasure that we acknowledge Anders Storvik for his recent visit to the New York Stock Exchange and his participation in the Capital Group conference in New York City.

Anders' commitment to continued education and staying abreast of industry developments is a testament to his dedication to providing our clients with the highest level of service. His insights gained from this experience will undoubtedly enhance our ability to navigate the complexities of the financial markets and better serve your unique needs.

Celebrating Achievements at Wela Financial Advisory

Before we conclude, we extend our congratulations to Christian Martinez for successfully obtaining his CFP designation. Christian's unwavering dedication and commitment to professional growth are commendable. His expertise and passion for client satisfaction make him an invaluable asset to our team.

At Wela Financial Advisory, we remain steadfast in our commitment to providing you with unparalleled financial planning, advice, and investment services. As we journey through 2024, our team is here to ensure that your financial strategies align with your goals and aspirations.

Thank you for entrusting us with your financial well-being. We look forward to helping you make your dreams a reality.

Warm regards,

Wela Financial Advisory

Brent Forrest & Associates, LLC dba Wela Financial Advisory( Wela) is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. Wela may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graph offer limited information and should not be used on their own to make investment decisions.